Starting Medicare

The 3 “New to Medicare” Decisions

When you are starting Medicare for the first time, whether you are turning 65 or just getting off work coverage, there are 3 decisions you have to make.

- Are you signing up for Part A & B OR are you continuing work past 65 and staying on your group insurance?

- Should you choose a Medicare Advantage Part C Plan OR Original Medicare (Parts A & B) combined with a Medicare Supplement?

- Which insurance company are you going to choose for your s Part C Advantage Plan or for your Medicare Supplement?

Let’s break down the decisions.

Are you starting Medicare at 65 or are you going to keep your group insurance?

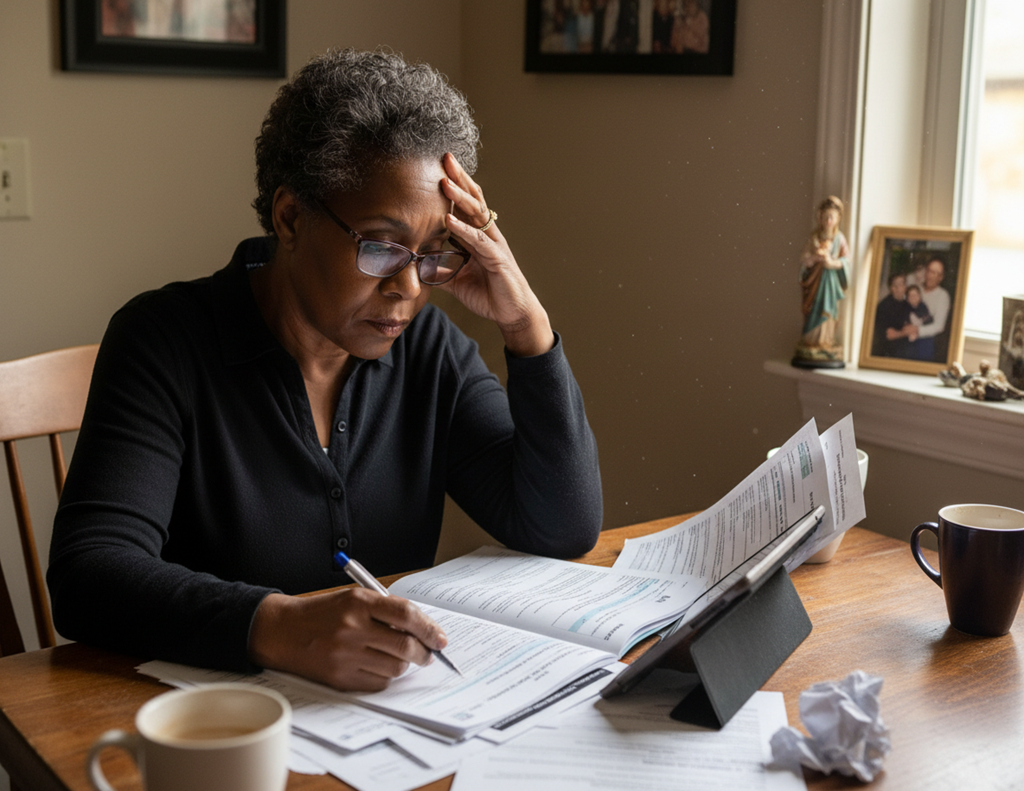

Many people turning 65 today are still working, or their spouse is still working, and they are covered under their work’s group insurance. If this is you, the first thing we need to look at is if it is better for you to stay on your work insurance or start Medicare.

For most people, their work insurance provides good, if not great, coverage at an affordable price, and they choose to stay on their work insurance until they retire.

For others, whose group insurance is expensive or does not provide great coverage, they opt to start Medicare right at 65.

Cardinal can help you compare your two options and see which one will fit your needs. For a large majority of our clients who are still working at 65, they choose to stay on their work insurance but start Medicare Part A. This is because Medicare Part A comes to you at no monthly cost.

Then, when they choose to retire, they start Medicare Part B and get rolling on the next decisions.

If you choose to delay Medicare coverage because you have work coverage, you will not receive any penalties from Medicare as long as your work coverage is creditable, which most are. If you contact us, we can advise you about this.

Are you going to choose Original Medicare or a Medicare Advantage Plan?

Once you decide that you are going to fully start Medicare, you have to choose which route you are going to take: Original Medicare or Medicare Advantage.

Original Medicare consists of Part A and Part B. These two by themself leave you with an uncapped 20% coinsurance. This is why most people on Original Medicare also have a Medicare Supplement, which covers this 20% and more.

If you are going with Original Medicare and a Medicare Supplement, you will also want to buy a Medicare Part D Drug plan and possibly separate dental and vision coverage. You can buy all of these from Cardinal. While there are more monthly premiums associated with this route, it provides you the most freedom. You can go to any doctor or hospital in the United States that accepts Medicare.

The 2nd Medicare route you can choose is a Part C Medicare Advantage Plan. When you sign up for a Part C Medicare Advantage Plan, you are taking your Part A and Part B coverage and moving it from the government (Medicare) to a private insurance company. Cardinal sells Medicare Advantage Plans in every state.

Part C plans are appealing to beneficiaries because they are affordable, they have very low, or even zero, monthly premiums. They also include Part D coverage and sometimes dental and vision. The drawback to these plans is that they have networks; you must go to their doctors and their hospitals.

Neither of the 2 routes is good or bad, it just depends on your individual circumstances, needs, and wants. At Cardinal, we are going to listen to you, understand your lifestyle, and then recommend the path we see working the best for you.

What insurance company are you going to purchase your coverage from?

No matter which route you choose, you have to purchase a Plan from an insurance company.

If you go with Part C, you purchase a Medicare Advantage Plan from an insurance company. If you go with Original Medicare, you purchase a Medicare Supplement and a Part D Prescription drug plan from an insurance company.

Where it really gets confusing is that the same large insurance companies sell Medicare Advantage Plans as well as Medicare Supplement Plans.

For Medicare Supplements, the government made it a little bit easier by standardizing plans. That means that all the plans of the same “letter” provide the exact same coverage, no matter the company you get it from. The only difference between the companies is price and service.

Part D Prescription Drug plans are not standardized, meaning they vary in prices charged, prescriptions covered, and preferred pharmacies. Medicare.gov has a tool where you can put in your prescriptions, locations, and other information and it will give you plans that are available in your area.

At Cardinal, we have our own Part D platform so we can help you choose a Plan. We take a more personal approach to getting you enrolled in a drug plan and can help you make the best decision.

Medicare Advantage plans are going to vary in networks, costs, drug coverage, and extra benefits; they are not standardized.

It is really important that you work with an agent who sells for multiple insurance companies. This guarantees that you can choose from the lowest cost Medicare Advantage Plans and it will cover your needs. There is one chance per year to change your Medicare Advantage Plan, so it is important you don’t end up in a Plan that doesn’t work for you.

Explore the 2 Medicare Routes

Starting Medicare and have more questions?

We are here to help you through your Medicare journey. Schedule a call with us to get help making the 3 critial Medicare decisions.

Learn More

- Income Taxes, IRAs, Life Insurance and Estate Planning, Long-Term Care, Medicare, Retirement Income, Social Security

- Income Taxes, IRAs, Life Insurance and Estate Planning, Long-Term Care, Medicare, Retirement Income, Social Security