How We Work

Cardinal’s Core Values

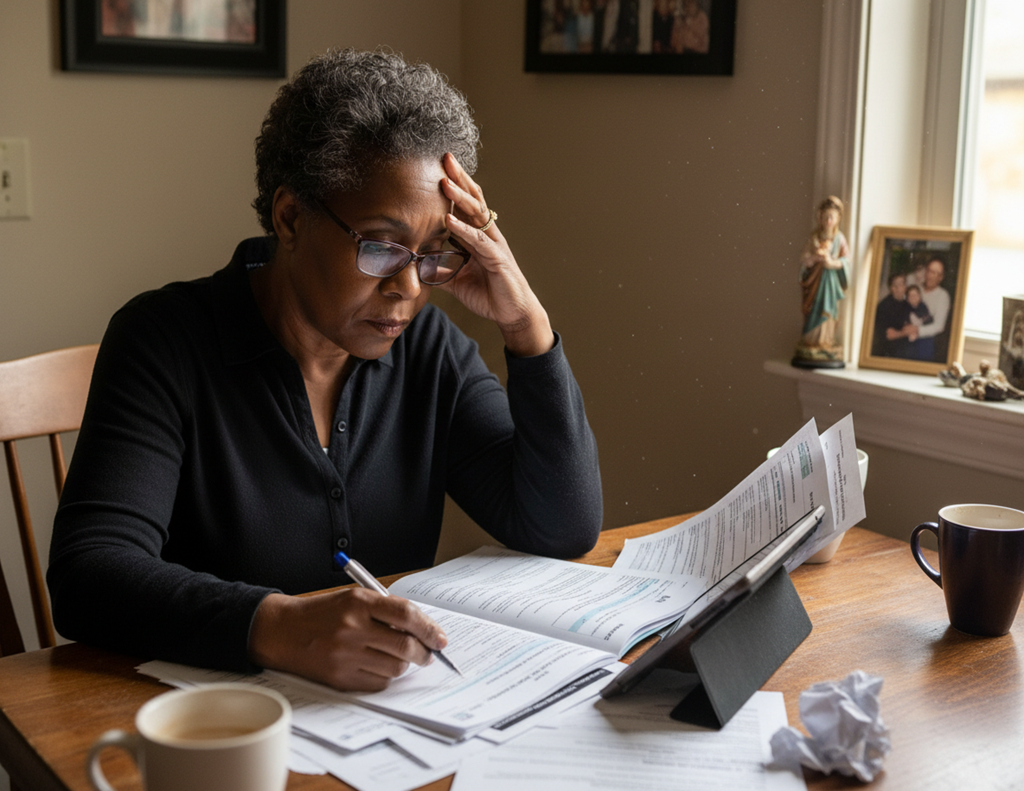

We believe in and practice individual responsibility, so we look for clients who believe their financial situation in retirement is their personal responsibility. It is our responsibility to help them make the most of what they have.

Open and honest communication means clients hear both the good and the bad in all of our recommendations. We don’t smooth over difficult subjects like sickness, incapacity, aging, and death. We look for clients who are open and transparent with their finances, their heirs, and their wishes about how they want to be “cared for” in the end of their life.

We don’t manipulate responses to hard questions. In fact, we look for clients who come to trust us enough to share their vulnerabilities.

We have no hidden agendas. As CFP® (Certified Financial PlannerTM) professionals, we have a fiduciary responsibility to lead clients to the financial decisions that are best for them.

We learn about a client’s situation through inquiry, educate clients about their choices, and then present our recommendations. We ask clients to purchase products from us, though it is not a requirement.

We also believe that experiencing discomfort is necessary for change, personal growth, and planning. Retirement is a new phase in life and comes with many changes. It is uncomfortable to talk about money, declining health, long term care, and death, for both our clients and us. All of us grow from dealing with our discomfort.

Every recommendation we give is prepared in a value conscious manner. We do not give all our clients the same recommendations, we look at each individual’s specific situation.

Value-Conscious Choices means that both of us are experiencing emotions while making decisions. Our clients make decisions based on logic and reasoning while also honoring their emotions, such as love for their families, fear of loss, and avoidance of pain and suffering.

We abide by The Golden Rule. We believe in treating all people as we want to be treated, people are not objects or vehicles for our own fulfillment. We expect the same treatment from our clients.

Many people make financial and insurance decisions from a place of fear, embarrassment, disappointment, loneliness, or sadness. While we acknowledge and validate these difficult emotions, we also work to identify a client’s hopes and dreams for themselves and their family. Then we work together to apply some logic and planning to their financial decisions.

We don’t claim to live these values perfectly, but we try our best every day. These principles ensure we can work with clients sharing mutual trust and respect, and together we can effectively and successfully plan for retirement.

Explore Our Company

The Learning Center

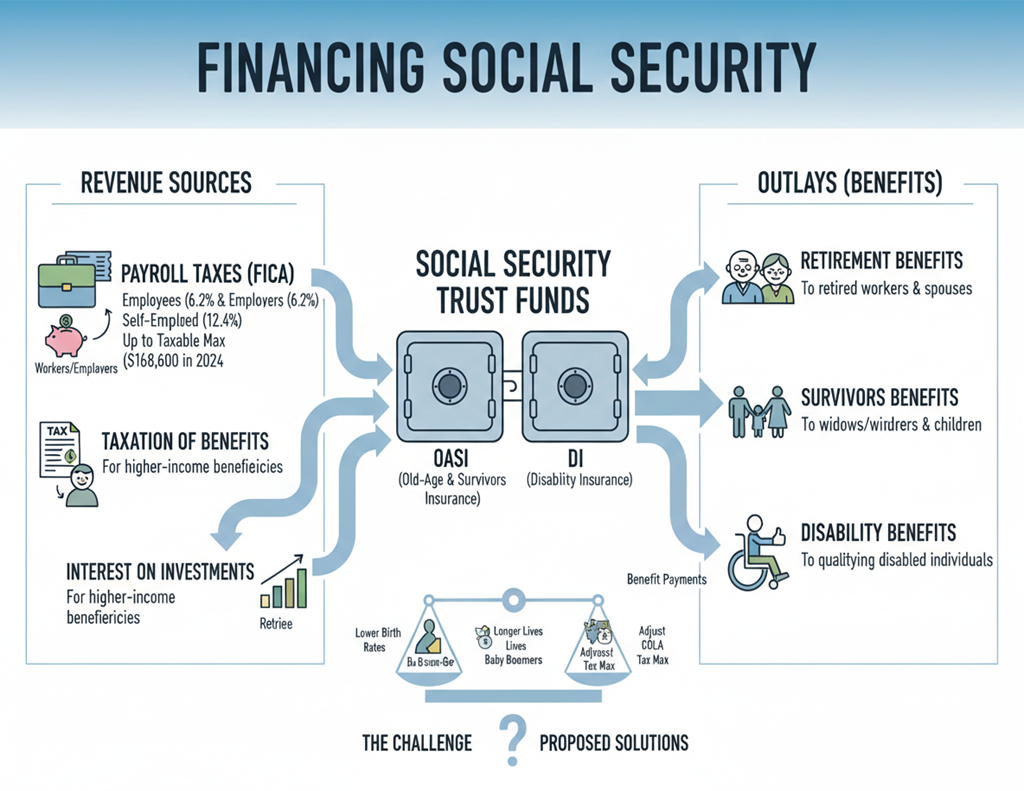

- Income Taxes, IRAs, Life Insurance and Estate Planning, Long-Term Care, Medicare, Retirement Income, Social Security