Social Security

Social Security is the foundation of your retirement income plan. Beginning at age 62, you have 96 different start date options when you can turn on Social Security. Starting your check at the right time can make a difference of tens of thousands of dollars during your, and your spouse’s, lifetime.

Social Security timing is more than just an algorithm; we must take into consideration your personal wants and needs for income. Some clients just want to start it early, some need it early, others want to delay until 70 to make their check as large as possible.

It is crucial to make the right decision when it comes to starting your Social Security check. You do not get a redo.

Questions we can answer

- When should I take my Social Security check?

- What is my Social Secuirty Full Retirement Age?

- Can I claim my spouses, or ex-spouse’s, Social Secuirty?

- Can I get more money from Social Secuirty?

- Should I take my Social Security check if I’m still working?

Get your free report

Cardinal is offering you a complementary Social Security timing report for you to learn about your Social Security decisions. Complete the form below to start the process of getting your report.

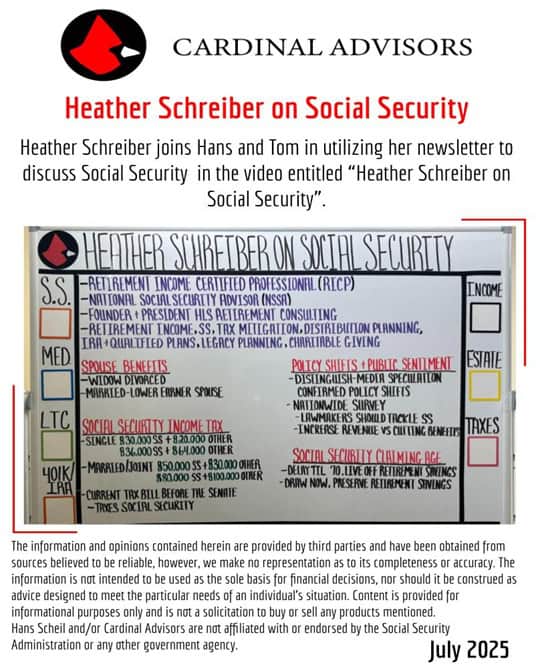

Cardinal Lessons on Social Security

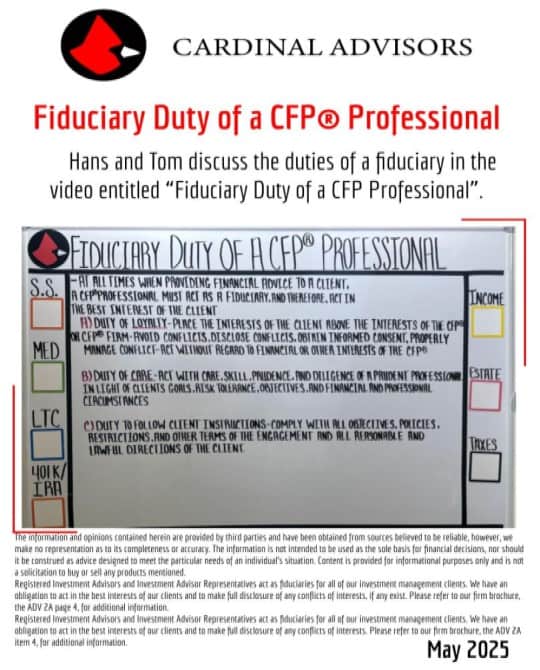

Fiduciary Duty of a CFP® Professional

When it comes to financial advice, trust and transparency are everything—especially in retirement. In today’s Cardinal Lesson, Hans Scheil and Tom Griffith, both CFP® professionals, explain what it truly means to be a fiduciary—and why it matters to you. If you’ve ever wondered whether your advisor is truly working in your best interest, this video is for you. It’s not about selling products—it’s about serving people. Subscribe to our channel for more clear, honest retirement guidance!

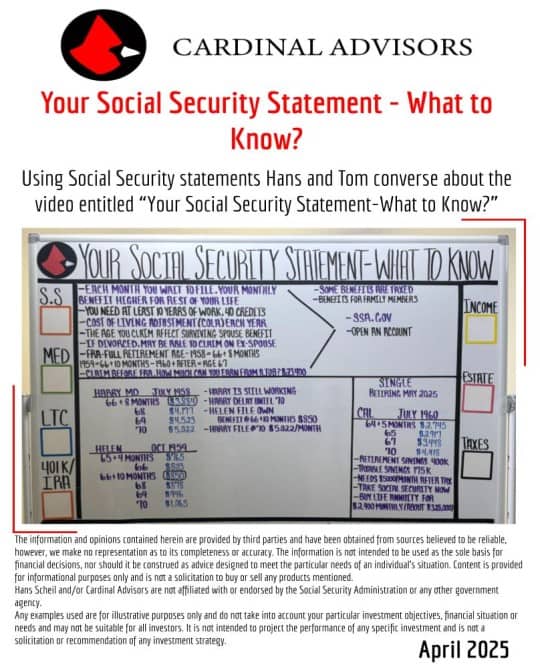

Your Social Security Statement – What to Know?

In today’s Cardinal Lesson, Hans Scheil and Tom Griffith walk you through your Social Security statement—what it is, how to get it, and why it's one of the most important documents for your retirement planning. Watch to get answers.

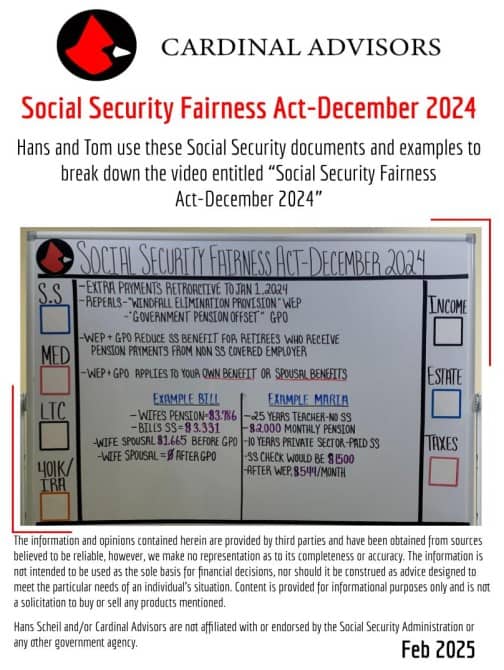

Social Security Fairness Act-December 2024

Big changes to Social Security! The Social Security Fairness Act was signed into law at the start of 2024, officially repealing the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). This means higher Social Security checks for many retirees who worked in non-covered government jobs! In this video, we explain: What the Social Security Fairness Act does. How it impacts teachers, government employees, and public workers. Who qualifies for higher Social Security benefitsWhat steps you should take if you’re affected and real-life examples of how much benefits are increasing. Watch the video to learn more!

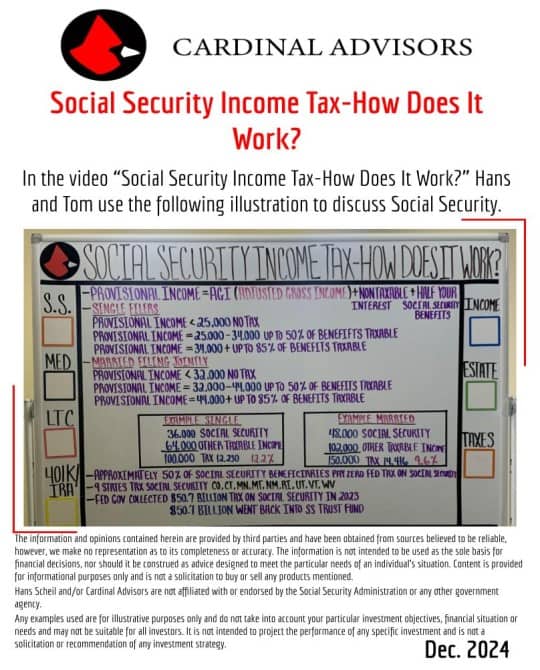

Social Security Income Tax – How Does It Work?

Are you confused about how taxes apply to your Social Security benefits? You’re not alone! In this video, Hans Scheil and Tom Griffith break down the complexities of federal income tax on Social Security, providing real-life examples and actionable insights to help you better understand and plan for your retirement income. Watch the video to gain more insight!

Delay Social Security Filing to 70-Example

Welcome to Cardinal Advisors' YouTube channel! In today's episode, we continue our deep dive into Social Security planning with Tom and Chelsey in the spotlight. This is the third part of our four-part series where we explore crucial financial decisions that could impact your retirement. Today, we tackle the pivotal decision of delaying Social Security benefits. This can profoundly influence your financial security throughout retirement, especially for couples like Tom and Chelsey. Watch the video to see how.

Social Security Maximization – 2 Examples

Welcome to today's Cardinal lesson! In this session, we thoroughly examine Social Security maximization, exploring key terms like Full Retirement Age (FRA) and crucial decisions impacting your retirement income. Understanding when to start your Social Security benefits—from age 62 to 70—can significantly impact your financial future. Join us as we discuss real case studies and strategies to help you make informed decisions tailored to your unique situation.

Social Security Trustees Report May 6, 2024

We’re diving deep into the Social Security Trustees Report released on May 6th. Amidst the headlines proclaiming Social Security is running out of money by 2035 and benefits will be cut to 80%, we found a lot of misconceptions. Many articles didn’t seem to reflect the actual content of the Trustees Report. Watch the video to learn more.

Age For IRA Catch-Up, Social Security, Medicare, FRA, RMD, & QCD

Welcome to today's Cardinal lesson where we're discussing the key ages and milestones as you approach and enter retirement. Understanding these ages is crucial to making informed decisions and avoiding costly mistakes. From early ages like 50 to critical milestones at 65, 66, and beyond, we cover what you need to know and do at each stage.

Delay Social Security? Take It Early? Wait Until 70?

Today we examine one of your most significant retirement decisions: when to start claiming Social Security benefits. Should you claim early, delay until age 70, or choose somewhere in between? We bring clarity to this complex topic by presenting detailed financial calculations and scenarios to illustrate the impact of each choice on your retirement income.

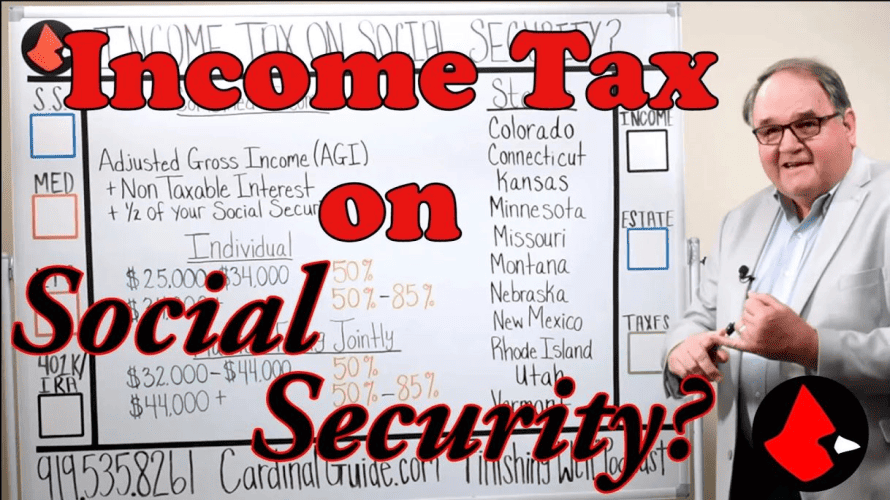

Income Tax on Social Security?

Today's episode of Cardinal Lessons is an insightful plunge into the world of Social Security taxes. We tackle some common questions and misconceptions about how Social Security benefits are taxed. Whether you're preparing for retirement or just curious about how your benefits might be affected, this video is a must-watch!

7 Worries – Retirement Planning

Welcome to our special video where we explore the essence of what we do at Cardinal. Our journey on YouTube started somewhat accidentally, but it's blossomed into a thriving community. Today, we focus on the core of our mission: addressing the seven critical worries in retirement. These worries aren't just about what keeps you up at night; they're about making informed decisions in pivotal areas of your retirement planning, often in your 60s, but sometimes earlier or later.

Social Security Increases For 2024

Welcome to the Cardinal Show! In today's episode, we delve into the upcoming Social Security increases for 2024, a crucial topic for anyone approaching retirement. The increase of 3.2% in Social Security checks nationwide is significant, and we're here to explain what it means for you.

The Cardinal Guide To: Social Security

Listen to learn:

You can start collecting reduced Social Security benefits as early as age 62. However, if you’d like your full Social Security benefits, you’ll have to wait until your Full Retirement Age (FRA). For those born between 1955-1959, your FRA is 66 + a few months depending on your birth year. For people born in 1960 and later, FRA is 67.

You can delay starting Social Security as far out as age 70. The longer you hold off, the larger your check will be. Benefits grow every month that you delay your check. Signing up for a My Social Security account at SSA.gov gives you access to your projected benefits at every age.

Spousal benefits and spousal survivor benefits are affected by the age at which the primary earner starts receiving benefits. If you are collecting spousal benefits, you are entitled to half your partner’s Social Security benefit at FRA. If your partner starts their check early, they could diminish your survivor benefit as well.

Divorcees can collect on their ex-spouse’s earning record if they meet some requirements. Widows or widowers can collect Social Security as early as age 60. Certain actions, such as remarriage before age 60, can affect eligibility for these benefits.

You’ll pay income taxes on your Social Security check if your other income exceeds certain levels. This is based on your “combined income”. In 2021, if you are single and make more than $25,000, or married and make more than $32,000, up to 85% of your Social Security check will be taxed. State taxation will differ; some states do not tax Social Security at all, while others tax it as regular income.

Social Security planning has long-term care implications. Social Security is the base income used to pay your long-term care bill, and the remaining amount is made up from other income. This applies if you don’t have long term care insurance. The average Social Security check is $1,400, while the average monthly cost of home health care $4,500. There is a large difference between these numbers.

You’ll pay income taxes on your Social Security check if your other income exceeds certain levels. This is based on your “combined income”. In 2021, if you are single and make more than $25,000, or married and make more than $32,000, up to 85% of your Social Security check will be taxed. State taxation will differ; some states do not tax Social Security at all, while others tax it as regular income.

Get In Touch

Contact us today with any questions, concerns, or just to stay connected.

Get your Social Security Timing Report!

[contact-form-7 id="d91790a" title="Contact Us"]

The Learning Center

Recommended Blogs

- Life Insurance and Estate Planning

- Income Taxes, IRAs, Life Insurance and Estate Planning, Long-Term Care, Medicare, Retirement Income, Social Security