Long-Term Care

At Cardinal, Long Term Care planning is our passion. We see the difference it makes at the end of our clients lives, for them and their family, if they have properly planned for long term care.

Unfortunately, we also have experiences of helping families who did not properly plan and ended up in a long term care crisis.

Many people are scared to talk about long term care because they associate planning for care with nursing homes. This is not true anymore. There are so many options for care, where you receive care (like at home), and how you pay for it.

Questions we can answer

- How will I pay for long term care? Can I use IRA money or life insurance cash value?

- How do I help my parents with their long term care situation?

- Can I get long term care insurance having preexisting conditions?

- Can I get a policy that will pay for long term care at home?

- Does Medicare or Medicaid pay for long term care?

Need a plan?

Cardinal Lessons on Long Term Care

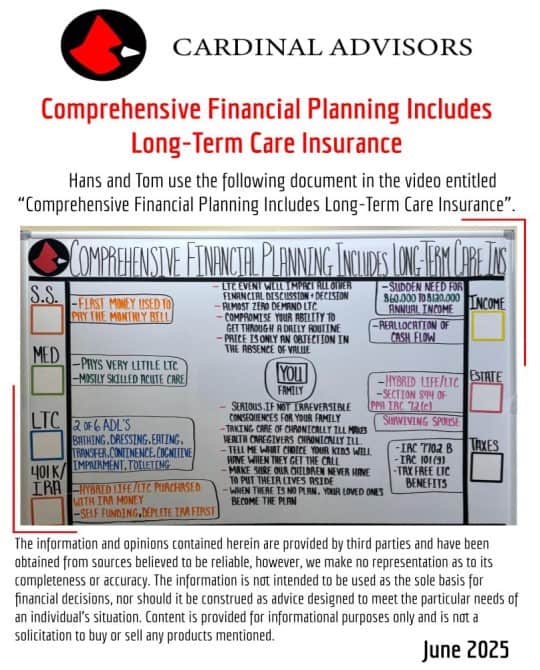

Comprehensive Financial Planning Includes Long-Term Care Insurance

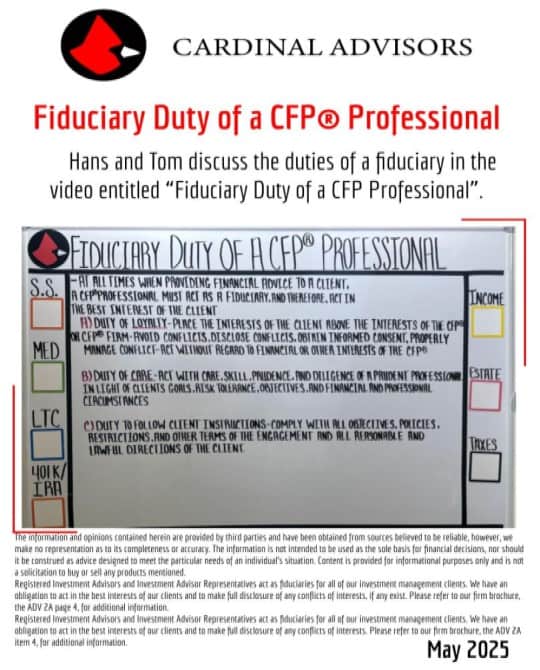

Fiduciary Duty of a CFP® Professional

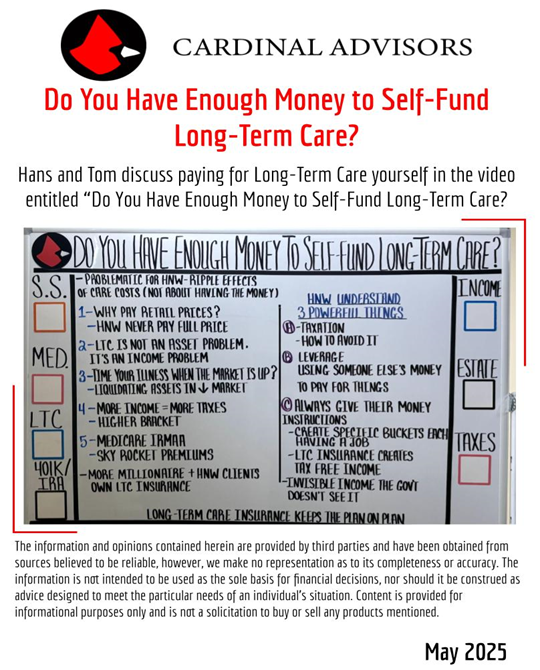

Do You Have Enough Money to Self-Fund Long-Term Care?

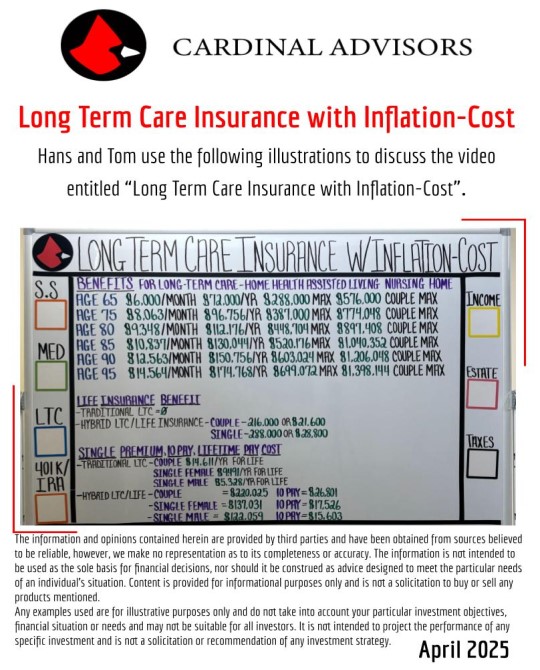

Long-Term Care Insurance with Inflation-Cost

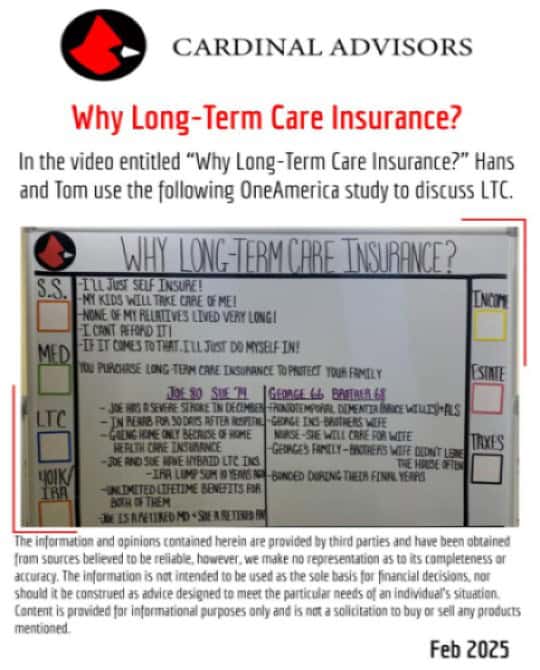

Why Long-Term Care Insurance?

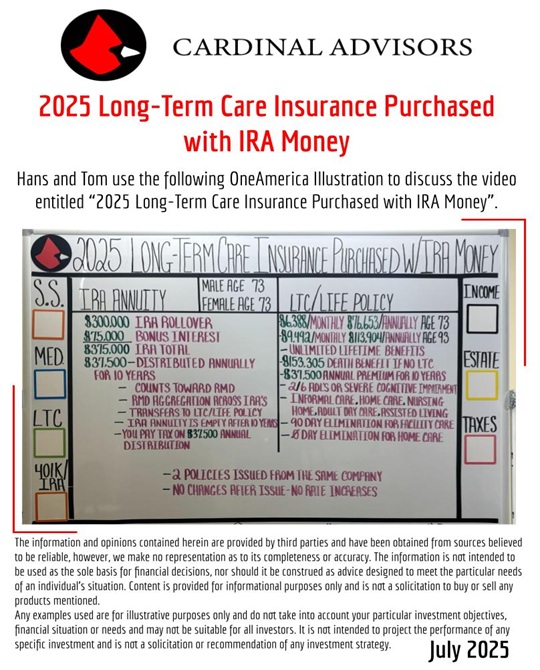

Long-Term Care Insurance – Purchased With IRA Money

Hybrid Life/Long Term Care Insurance-IRA Money

Long-Term Care Insurance – 5 Examples with Rates

Can’t Get Long-Term Care Insurance Because of Your Health?

Long-Term Care Insurance – Pay For It Yourself?

Long-Term Care Annuity $100,000 Single Premium

7 Worries – Retirement Planning

The Cardinal Guide To: Long Term Care

Listen to learn:

Americans are living longer. Studies show that about 70% of the people turning 65 today are going to end up needing long term care services. The financial consequences of that care can be devastating to families who pay out of pocket.

Long-term care doesn’t mean you’ll end up in a nursing home. In fact, most of our clients prefer and opt into alternate options; this includes home health care, assisted living, and adult day care. Progressively more people are cared for at home with paid assistance coming in to help.

Short Term Care Insurance is a more affordable option for covering the long term care bill. These policies give you coverage for up to 1 year of care, usually in your home. If you need care for longer than a year, this year of coverage gives your family time to organize your finances to continue paying for care.

Traditional long term care insurance still exists, though less and less consumers are choosing it due to the cost and the “use it or lose it” nature. If you already have a traditional long term care policy, Cardinal can evaluate it to make sure it still fits your needs and budget.

Hybrid long term care insurance was created to contrast the “use it or lose it” factor of traditional long term care. Hybrid long term care combines long term care insurance and life insurance. If you need long term care services, the insurance will pay a significant amount for it. If you end up not needing care, your loved ones will get a life insurance benefit paid out to them.

You are not limited to one solution for long term care; many people mix and match insurance products, savings, and their Social Security benefit, coming up with a personal plan for paying for care.

Medicare does not pay much for long term care. Medicaid will pay for this care, though it should be your last resort. To be eligible for Medicaid, you must drain almost all your assets and you will not have much of a choice about the facility you end up in.

Consider a Partnership long term care policy, which allows you to go on Medicaid while protecting some of your assets. This means that if you buy a long term care policy and run out of benefits, you do not have to drain all of your assets in order to get Medicaid to start paying for some of the care.

There can be significant tax advantages in properly planning for long-term care. Work with a qualified professional to end up with a policy that will cover your long term care expenses and possibly lower your tax bill.

Get In Touch

Contact us today with any questions, concerns, or just to stay connected.

Questions about Long Term Care?

The Learning Center

Helpful

Resources

Recommended Blogs

- Life Insurance and Estate Planning

- Income Taxes, IRAs, Life Insurance and Estate Planning, Long-Term Care, Medicare, Retirement Income, Social Security