Taxes for Retirees

Income taxes are affected when you turn 65, go on Medicare, start your Social Security check, start drawing down your IRA, possibly need long term care, and leave money to your spouse or kids.

There are simple ways to minimize the tax of your estate—if you know the mechanics of how various assets are valued and the details of tax law. There is great value in consulting with an expert; mistakes are costly.

Questions we can answer

- How do income taxes change in retirement?

- Do I pay taxes on my Social Security?

- What is the Medicare tax or IRMAA?

- When do I pay taxes on my IRA and 401(k) money?

- How can I reduce my income tax in retirement?

Taxes in Retirement

Cardinal Lessons on Taxes

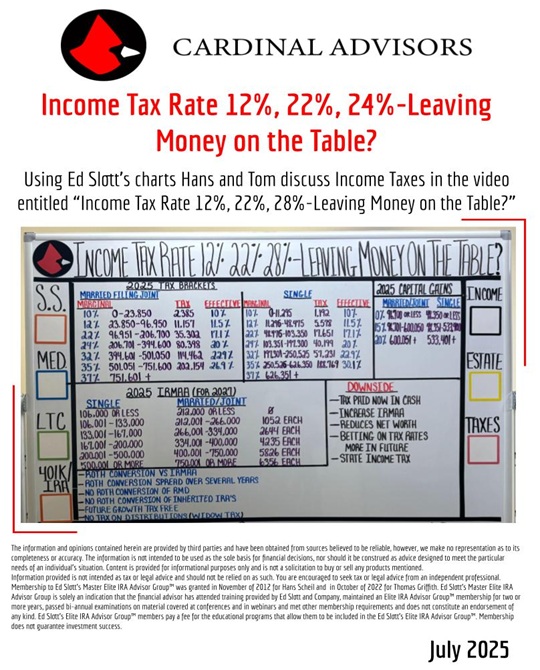

Income Tax Rate 12%, 22%, 24% – Leaving Money on the Table?

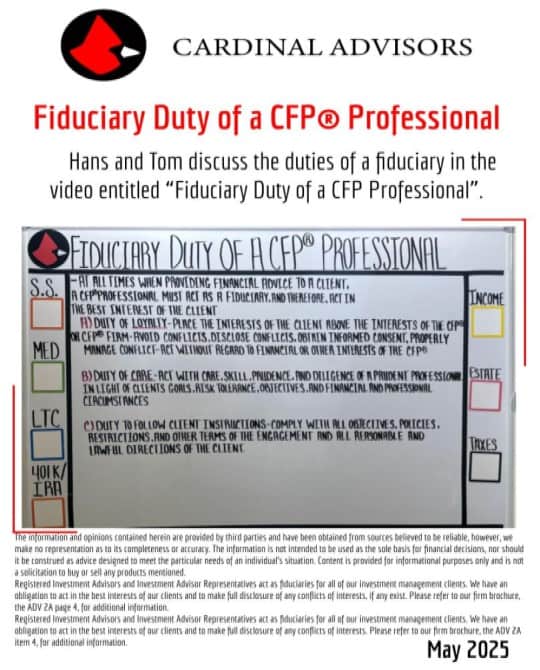

Fiduciary Duty of a CFP® Professional

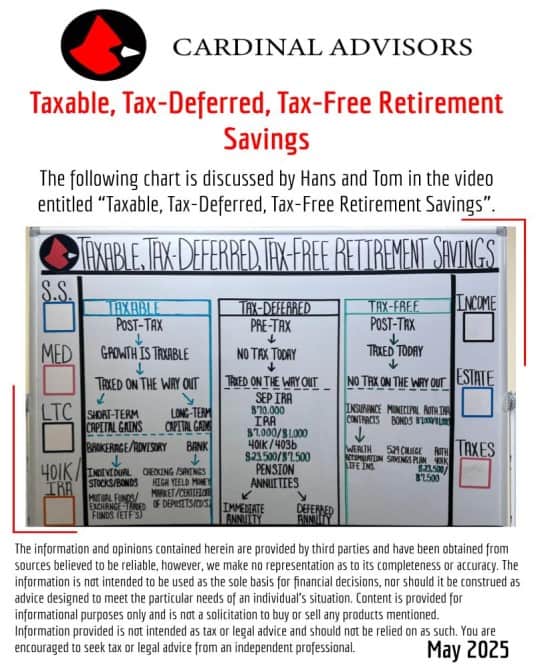

Taxable, Tax-Deferred, Tax-Free Retirement Savings

Financial Asset Classes for Retirement Income

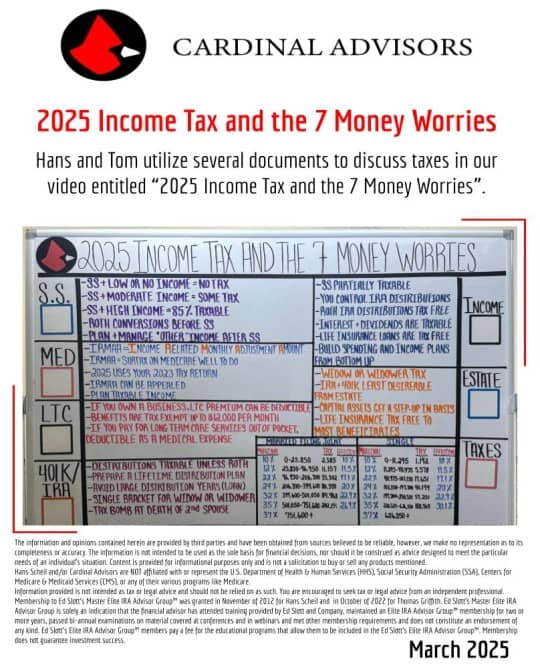

2025 Income Tax and the 7 Money Worries

Guaranteed Retirement Income Increases Retirement Satisfaction

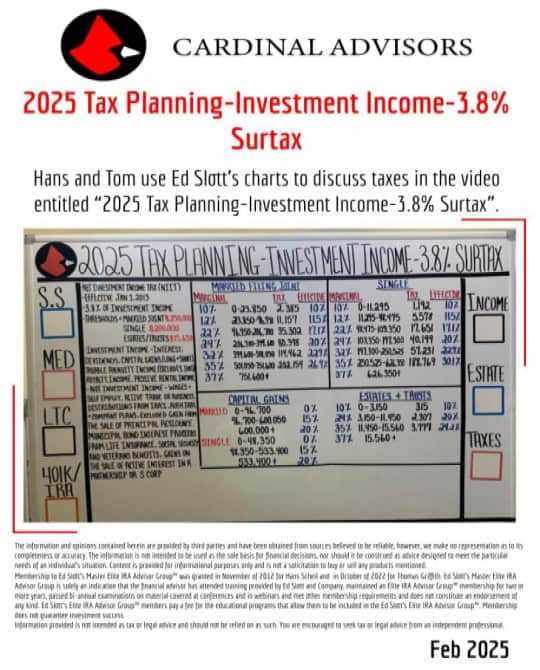

2025 Tax Planning-Investment Income-3.8% Surtax

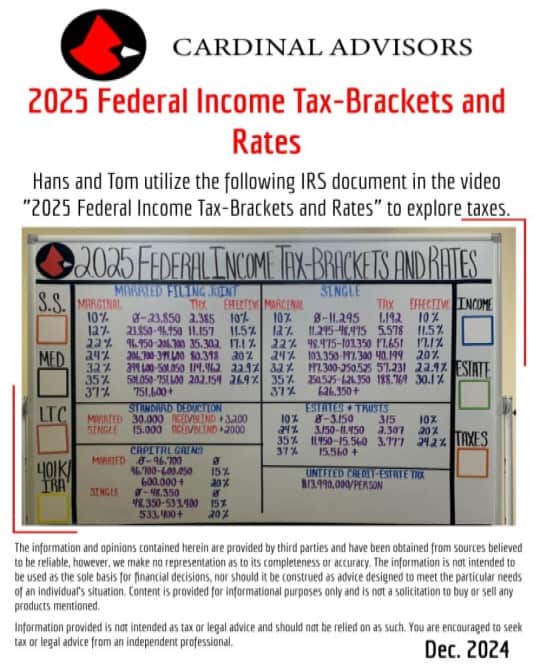

2025 Federal Income Tax – Brackets and Rates

Capitalize on Low Tax Rates 2024 & 2025

2024 Tax Planning

The Income Tax is the New Estate Tax

Tax Problems? IRS Enrolled Agent

The Cardinal Guide To: 62+ Taxes

Listen to learn:

Up to 85% of your Social Security can be taxed depending on your “other taxable income” in a given year. In 2021, if your combined income is above $25,000 as an individual, or above $32,000 as a couple, some of your Social Security check will be taxed. State taxes on Social Security vary, with some states completely excluding Social Security from state income tax and others taxing it as regular income.

Medicare applies a surcharge to higher-income beneficiaries. IRMAA, or the Income Related Monthly Adjustment Amount, is an additional tax charged on your Part B and Part D monthly premiums. In 2021, if you make over $88,000 as an individual, or $176,000 as a couple, you can be subject to IRMAA charges.

Purchasing long term care insurance has tax benefits. Not only are the benefits paid to you tax-free, but there is a way to deduct some of the premiums paid for long term care insurance.

IRAs and 401(k)s allow you to postpone income taxes, but you can’t avoid income taxes altogether. RMDs must start by age 72. RMDs increase your taxable income, and possibly increase your Social Security and Medicare taxes. Consider using a Roth IRA, or a Roth IRA conversion, to reduce your taxable income in retirement.

There are income taxes even in death. If you leave a traditional IRA or 401(k) to your heirs, they will have to pay the income taxes before they can use the money.

Get In Touch

Contact us today with any questions, concerns, or just to stay connected.

Want more information about taxes in retirement?

The Learning Center

Recommended Blogs

- Life Insurance and Estate Planning

- Income Taxes, IRAs, Life Insurance and Estate Planning, Long-Term Care, Medicare, Retirement Income, Social Security