Original Medicare

There are 2 routes you can take to receive your Medicare. Original Medicare is the first. This route gives you the most freedom, but does come with a higher monthly cost.

Option I

Original Medicare is the route most Medicare beneficiaries take when they start Medicare.

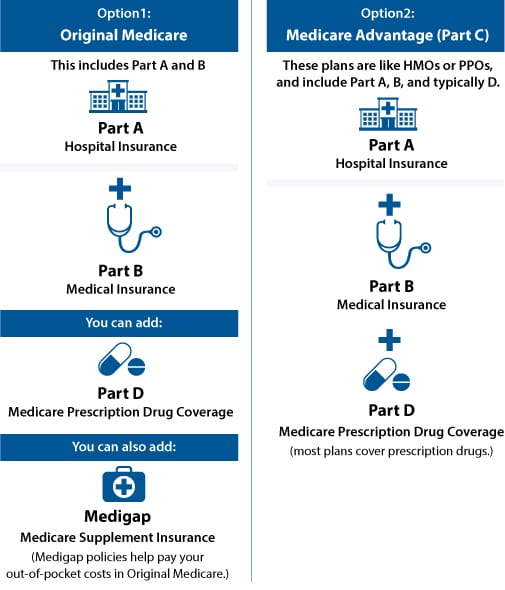

Original Medicare is made up of Part A, which covers hospital and inpatient expenses, and Part B, which covers doctor and outpatient expenses. Part A is premium-free for most while Part B requires you to pay a monthly premium. High income Medicare beneficiaries pay more for their Medicare Part B (IRMAA). Ask us about this if you think it might apply to you.

After signing up for Part A and Part B, you have the option to buy a Medicare Supplement (Medigap). These policies cover the 20% of costs that Original Medicare by itself doesn’t cover. You will also need to purchase a separate Part D Prescription Drug plan as well as vision and dental coverage if needed.

Pros of Original Medicare

No Network Restrictions

You can choose to go to any doctor or hospital who accepts Medicare, which is a large majority. This means that you can easily travel with Original Medicare plus a Supplement, which is especially great for snowbirds or those who frequently visit friends and family in other areas. Many also choose a Medicare Supplement for the ability to choose research hospitals and doctors when they are seriously sick.

Possibility of no co-pays, co-insurance, or even no deductibles

With certain Medicare Supplement Plans, you can have no copay, coinsurance, or deductible costs. In other words, you’d only have to pay your premium each month and nothing else. This is a good option for people who go to the doctor regularly, especially for those who go to specialists.

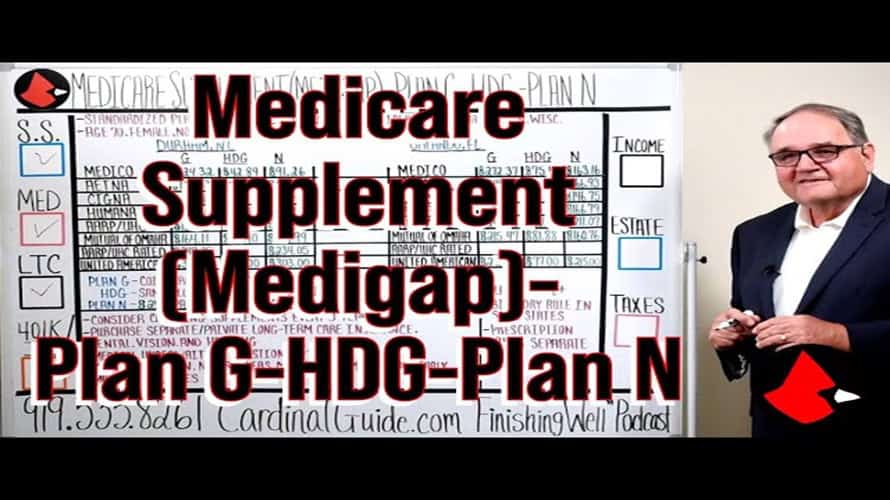

Choice of Supplement Plan

There are 10 different standardized Medicare Supplement plans, each named with a letter. Benefits offered by Plans of the same letter are exactly the same no matter which company you purchase your Plan from. The only difference between the companies offering the Plan is price and service, which means you can shop around for the lowest rate. (You can do that at the bottom of this page.)

For example, most of our clients go with a Plan G. If you run a free personalized quote below, you will get a list of 20-35 companies offering the Plan G and the price they are charging. All these companies are offering you the exact same “Plan G” coverage, the only difference between them is the price.

Supplements can be changed at any time during the year

Unlike Advantage plans, Supplements can be changed at any time during the year. If your Supplement price goes up and you want to save money by switching, you can.

Cons of Original Medicare

More Expensive

Your Medicare Supplement, Part D Drug plan, and, if you choose, dental and vision coverage are each paid for separately. These costs add up quickly, so if you’re on a tight budget, a Medicare Advantage plan might be a better option for you.

Health Questions for Medicare Supplement

If you want to switch your Supplement to save money, you must answer health questions (unless you’re in your open enrollment period). Health history can prevent some clients from switching, especially if new health issues have appeared since originally signing up for a Supplement.

Explore Medicare

Use Our Calculator For a Free Comparison of Plans

Enter your age, zip code, and smoker status to view results

Learn more about Original Medicare!

Medicare Supplement (Medigap)-Plan G-HDG-Plan N

Fiduciary Duty of a CFP® Professional

4 Steps to Medicare and Insurance at 65

2025 Medicare Surtax For High Income Retirees-IRMAA

Medicare 101 – Sign Up and Insurance

Original Medicare vs Medicare Advantage

Can You Appeal IRMAA (Medicare Tax)?

Medicare Knowledge If You’re 65+

Medicare Tax on High Income – IRMAA 2024

Turning 65 and Enrolling In Medicare?

Original Medicare + Medigap Plan ?G?

7 Worries – Retirement Planning

Get In Touch

Contact us today with any questions, concerns, or just to stay connected.