Navigating the Waters of Required Minimum Distributions (RMDs): Insights and Strategies from Cardinal Financial

Introduction:

In this edition of the Cardinal lesson, we jump into the crucial topic of Required Minimum Distributions (RMDs), which become a significant aspect of financial planning once you hit the age of 73. Our goal is to demystify RMDs, clarify the rules surrounding them, and share some of the strategies we’ve successfully implemented in our financial planning practice. But before we dive in, a quick personal update: a recent mishap led to an unexpected surgery, proving that life’s surprises can indeed keep us on our toes. Despite this, our commitment to providing valuable financial insights remains unwavering.

Understanding RMDs:

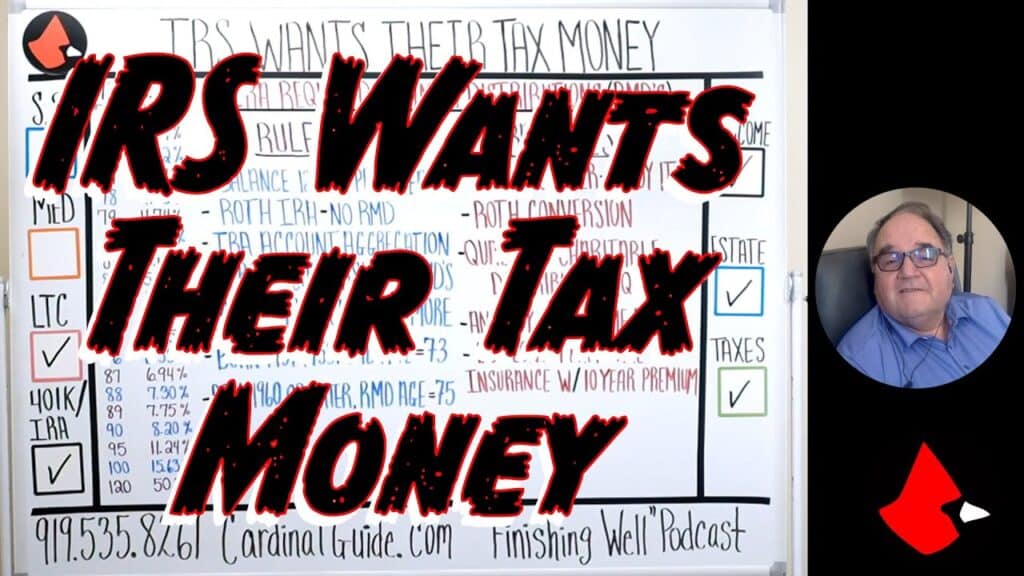

The Basics RMDs represent a key element in retirement planning, mandated to start at age 73 for most individuals. This segment aims to break down what RMDs are and why they play a critical role in your financial landscape. The recent shift from the traditional age of 70 to 73 (75 for those born in 1960 or after) underscores the importance of staying informed and prepared.

The “Why” Behind the Focus on RMDs Our focus on RMDs stems from the myriad of questions and misconceptions we encounter in our practice. Many are unaware of when RMDs commence, how they are calculated, and the implications of these distributions on their financial health. By addressing these questions, we aim to provide clarity and guidance, steering clear of the default government plan which may not always align with individual financial goals.

Strategies to Optimize Your RMDs Beyond the basics, we explore various strategies to manage RMDs effectively, tailored to enhance your financial well-being. From early withdrawals and Roth conversions to qualified charitable distributions, our approaches are designed to offer flexibility and optimize your retirement savings. Each strategy is discussed with practical examples, illustrating how they can be adapted to suit individual financial situations.

Annuities, Long-term Care, and Beyond: Advanced RMD Planning

We also delve into advanced strategies involving annuities and long-term care insurance, offering insights into how these options can be integrated into your RMD planning. These strategies underscore the importance of holistic planning, considering all facets of your financial picture.

Conclusion:

Crafting Your Personalized RMD Strategy As we wrap up this lesson, the key takeaway is the importance of developing a personalized approach to managing your RMDs. Whether you’re just beginning to explore the concept of RMDs or are looking for ways to refine your existing strategy, our insights aim to empower you with the knowledge and tools necessary for informed decision-making.