Medicare prev

From Parts, to Plans, to Premiums, Medicare is confusing. We break it down and lead you to a place where you can make educated Medicare insurance decisions.

We are Medicare experts who have access to over 30 Medicare Supplement companies and Medicare Advantage companies. We understand how Medicare plays into your larger retirement picture. We aren’t going to sign you up for a Plan because it is the cheapest option; we are going to find a plan that will work for you, your budget, and provides you the best coverage.

Questions we can answer

- When should I start Medicare?

- Can I start Medicare early?

- Should I buy a Medicare Supplement or Medicare Advantage Plan?

- Which company should I buy my Medicare insurance from?

- Can I save money on my Medicare insurance?

Use Our Calculator For a Free Comparison of Plans

Enter your age, zip code, and smoker status to view results

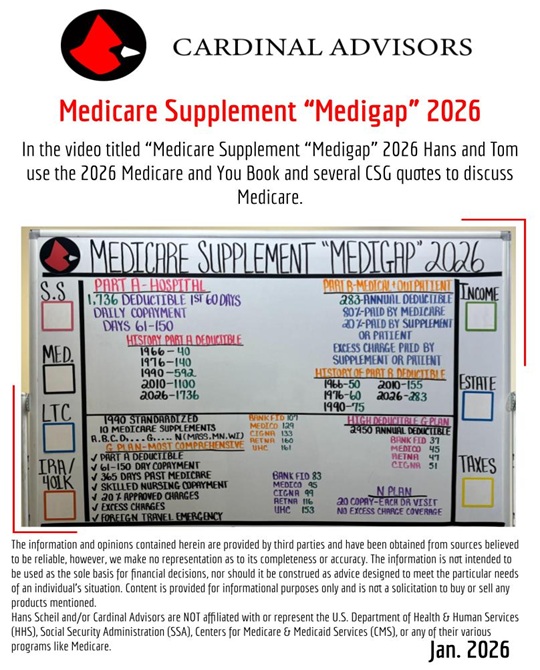

Cardinal Lessons on Medicare

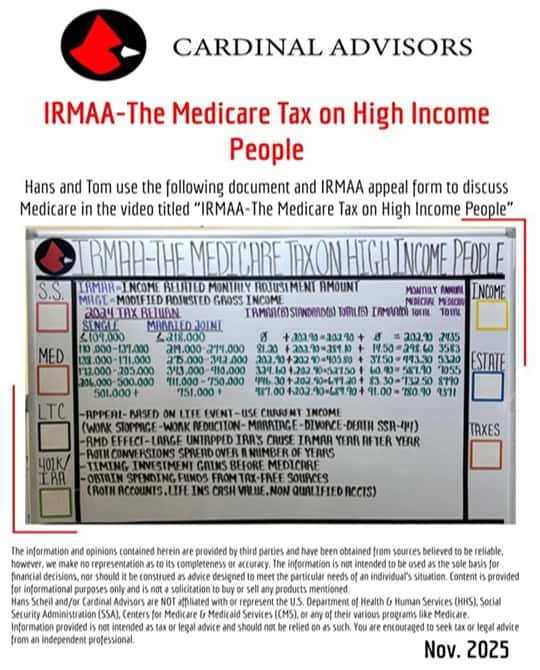

IRMAA-The Medicare Tax on High Income People

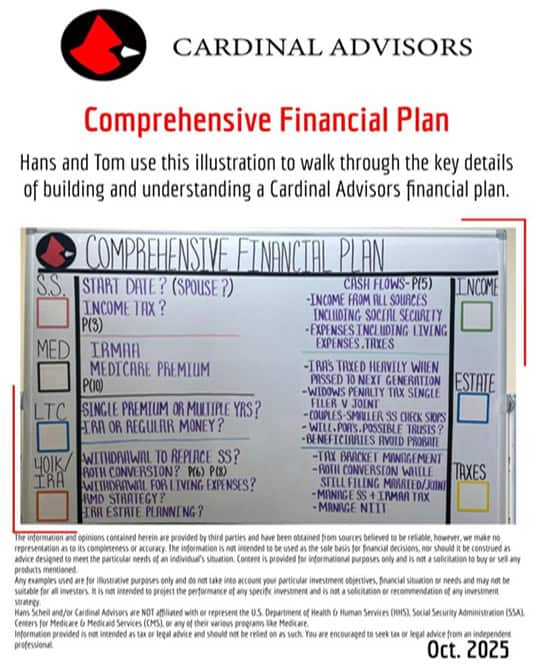

Comprehensive Financial Plan

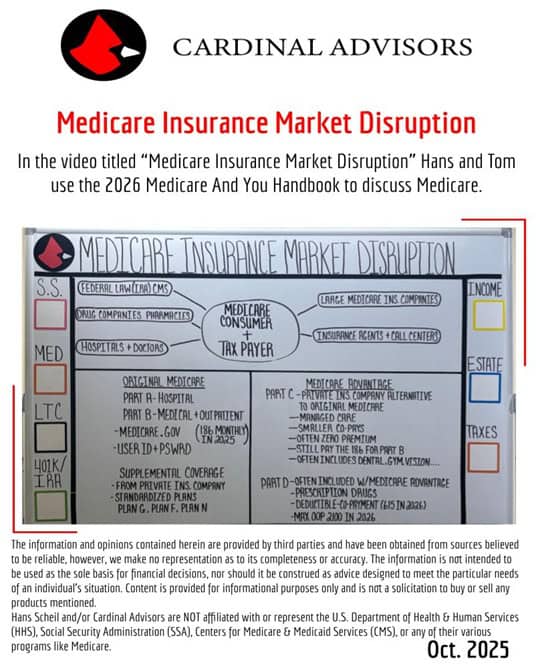

Medicare Insurance Market Disruption

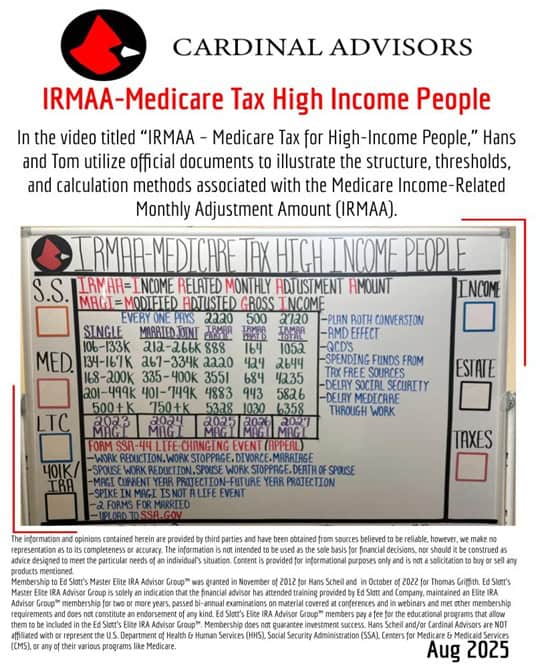

IRMAA – Medicare Tax High Income People

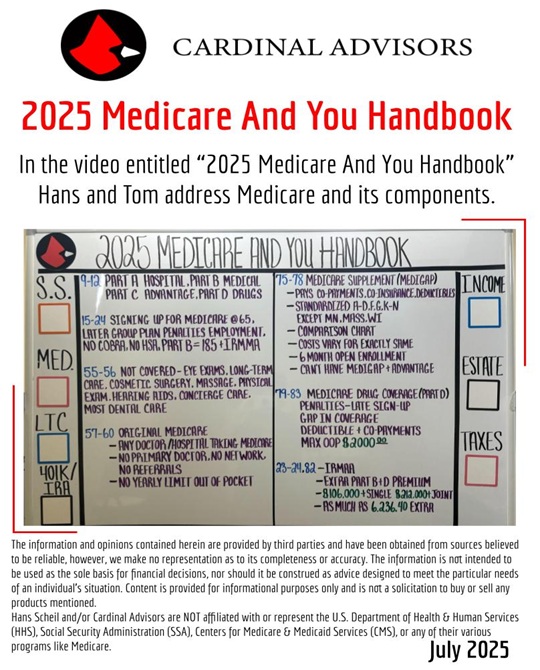

2025 Medicare And You Handbook

Medicare Supplement (Medigap)-Plan G-HDG-Plan N

Fiduciary Duty of a CFP® Professional

4 Steps to Medicare and Insurance at 65

2025 Medicare Surtax For High Income Retirees-IRMAA

Medicare 101 – Sign Up and Insurance

Original Medicare vs Medicare Advantage

Can You Appeal IRMAA (Medicare Tax)?

The Cardinal Guide To: Medicare Strategizing

Listen to learn:

Medicare has 4 Parts: Part A, Part B, Part C, and Part D. You will need a combination of some of these Parts to get your full Medicare coverage.

Part A and Part B make up Original Medicare. Part A covers your hospital and inpatient costs and Part B covers your doctor and outpatient costs. Medicare Part A and B start (for most people) on the first of the month of their 65th birthday. Part A has no monthly cost while Part B has a monthly cost, currently $148.50 for most in 2021.

If you are still working at 65 and covered by group insurance, or your spouse is still working and you are covered under their group insurance, sign up for Part A at 65 and delay enrolling in Part B until you retire or lose work insurance. If you have an HSA, there are special steps that need to be taken in advance of signing up for any Part of Medicare.

Medicare Part C is commonly referred to as Medicare Advantage. Medicare Advantage Plans facilitate you receiving your Medicare coverage (Part A and Part B) from a private insurance company instead of directly from the government. While these Plans have networks, they have low monthly costs and include extra benefits.

Medicare Part D covers prescription drugs. You will need to purchase a Part D plan from an insurance company when you sign up for Part B of Medicare. Even if you are not taking any drugs, it is in your best interest to sign up for a plan, as there can be large penalties down the road. If you are on a Medicare Advantage Plan, you will not need to purchase a Part D plan as drug coverage is included.

If you opt to stay on Original Medicare, you will need a Medicare Supplement to cover the uncapped 20% coinsurance Original Medicare leaves you with. Medicare Supplements do not have networks, giving you the freedom to go to any doctor or hospital you choose as long as they accept Medicare. There are 10 different Supplement plans to choose from, but the Plan G or Plan F is what we recommend for most people. Medicare Supplement plans are standardized, meaning all plans bearing the same letter are required to offer the exact same benefits, no matter the company you purchase it from. The only difference between companies is price and service.

The price of your Medicare Supplement can go up every year. Make sure to occasionally recheck your rate against other insurance companies. In other words, shop around because you might be paying too much. We can help you with this.

If you qualify for LIS (the low-income subsidy program) or Extra Help, the government might pay all or part of your Part B premium and reduce your Part D drug co-payments.

Prepare to pay higher-income surcharges for Medicare Parts B and Part D if your income is over $88,000 as a single person or $176,000 as a couple. This is called IRMAA, or the Income Related Monthly Adjustment Amount.

Don’t rely on Medicare to pay your long-term care bill because it doesn’t. Medicare does not cover much long term care costs; you will need another policy to pay for these services. Learn about turning 65 and how signing up for Medicare works.

Get In Touch

Contact us today with any questions, concerns, or just to stay connected.