IRAs, 401k, 403b

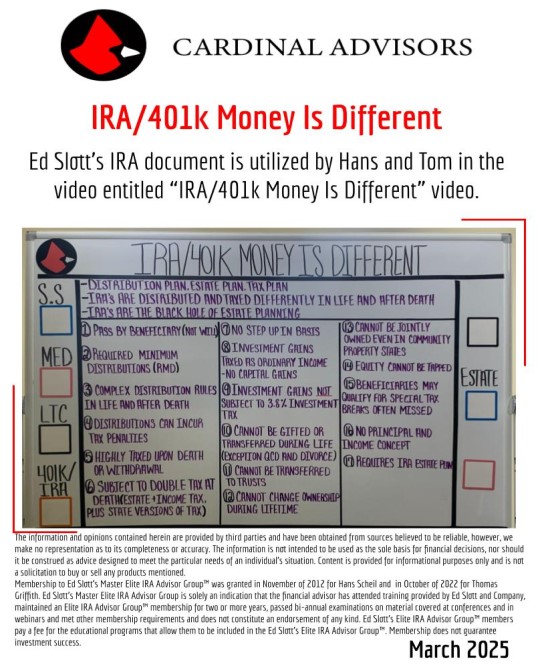

Your IRA, or 401(k), is most likely your largest financial asset and you are counting on it for retirement income. The most costly mistake in managing this money is not in how it’s invested, it’s account transfers or rollovers, beneficiary designations, and required minimum distributions.

If one wrong transaction is made with an IRA or 401(k), it is most likely irreversible and causes tax liabilities and possibly penalties.

Questions we can answer

- How do I turn my IRA or 401(k) into income in retirement?

- What are my Required Minimum Distributions?

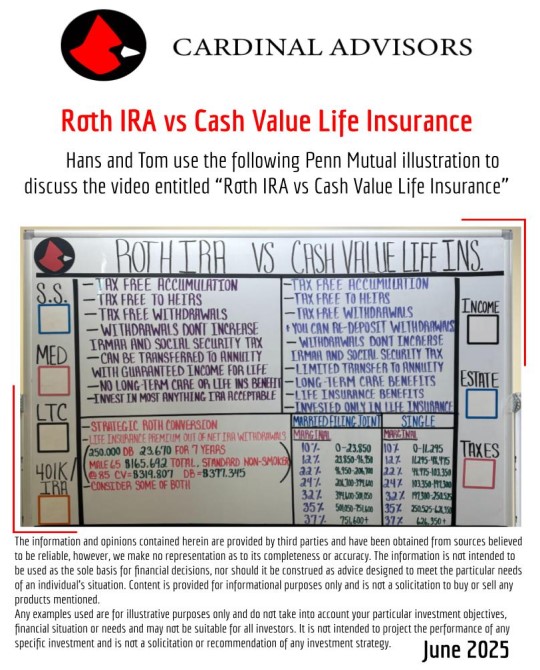

- What about my Roth IRA? Should I consider a Roth IRA conversion?

- Who should my IRA beneficiary be?

- Should I plan to leave my IRA to my heirs?

IRAs = Retirement Income

Cardinal Lessons on IRAs

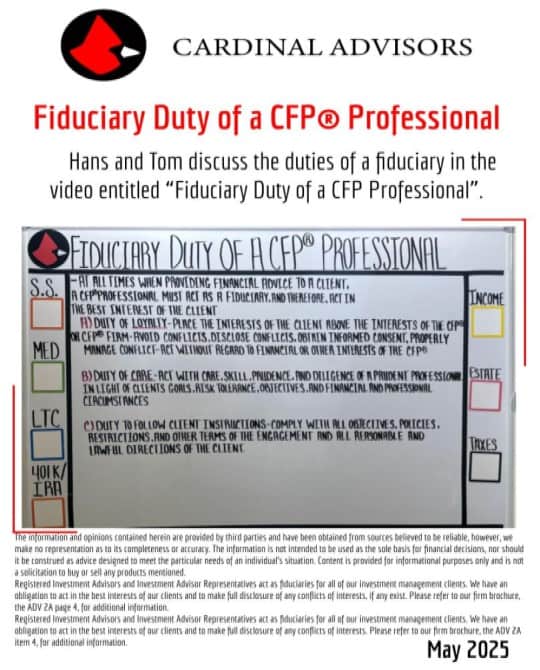

Fiduciary Duty of a CFP® Professional

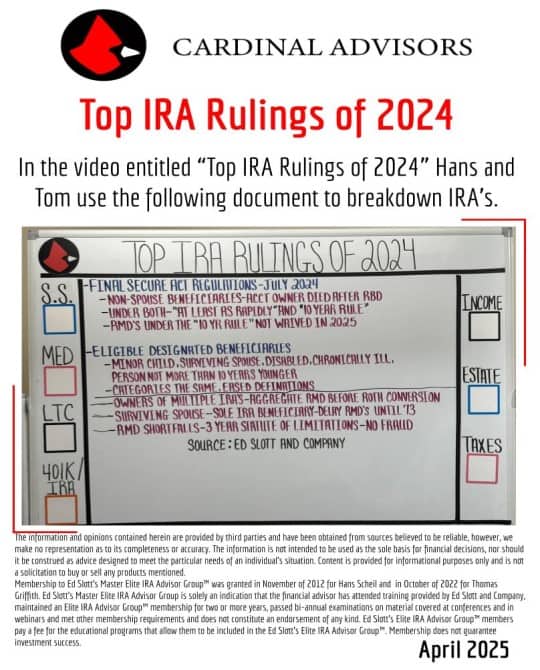

Top IRA Rulings of 2024

IRA/401k Money Is Different

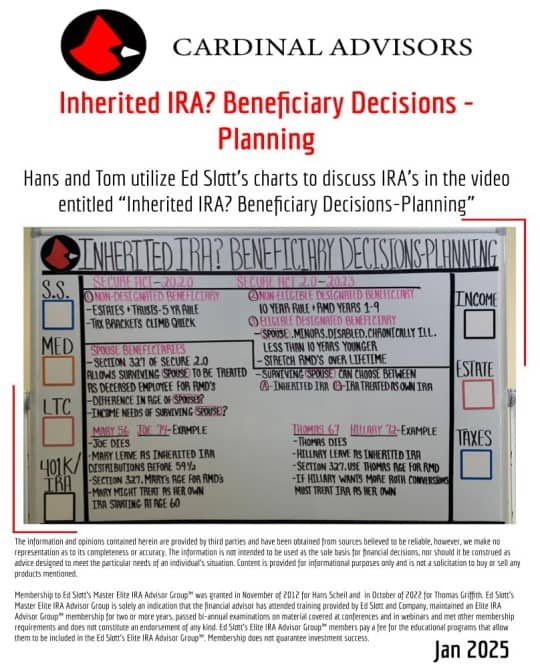

Inherited IRA? Beneficiary Decisions – Planning

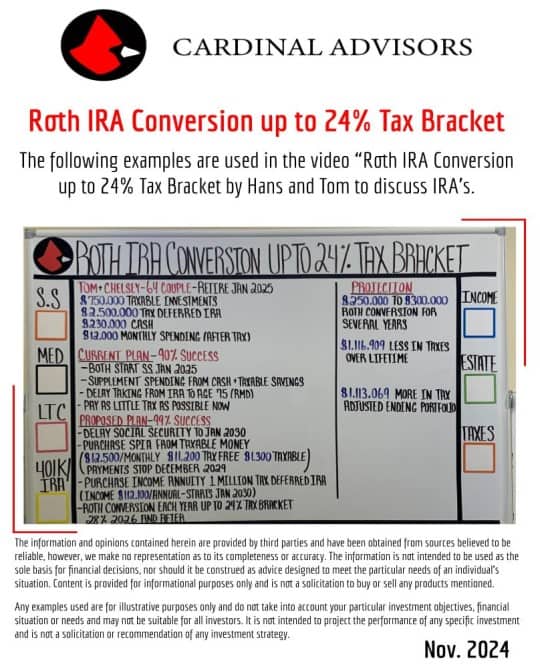

Roth IRA Conversion Up To 24% Tax Bracket

Charitable Distribution From IRA – No Income Tax

Inherited IRA? Be Smart About Income Tax

Tax Free IRA/401k vs Tax Deferred IRA/401k

IRS Wants Their Tax Money

Inherited IRA? Which Beneficiary Are You?

7 Worries – Retirement Planning

Getting the Money Out of a Roth IRA

The Cardinal Guide To: IRAs

Listen to learn:

Transfer IRA or 401(k) money from custodian to custodian. Don’t touch the money unless you want to risk paying taxes on all of it.

Update your beneficiary designations regularly. IRA and 401(k) money passes straight to the named beneficiary after death, bypassing the will and probate.

Required Minimum Distributions (RMDs) start at age 72 now that the Secure Act is law. In simple terms, you have postponed taxes in your IRA or 401(k) for years, and the government wants their tax money. RMDs are calculated based on the amount in your IRA and 401(k) and your estimated life expectancy. Failure to withdraw the appropriate RMDs will cause penalties as much as 50% of the shortfall.

RMDs can significantly increase your tax bill, resulting in taxes on income from Social Security and Medicare’s IRMAA. Qualified Charitable Distributions and Roth IRA conversions are strategies to lower tax from RMDs.

Stockpiling money in an IRA, taking only RMDs, to create an inheritance for your kids isn’t a smart estate planning strategy. There are ways to pay the taxes during your lifetime and leave tax-free money to your heirs.

IRAs are commonly one of the first places adult children go to pay mom or dad’s long term care bill. IRA withdrawals are taxable as ordinary income, and your long term care bill can create a corresponding tax deduction as a medical expense. But you need smart planning in order to optimize using your IRA for long term care. There are long term care insurance policies you can roll part of your IRA into for comprehensive long term care coverage. Cardinal Advisors can help you turn your IRA and 401k into pension payments over time.

If you take money from your IRA before age 59 ½ , you will incur very large penalties in addition to the tax. There are exceptions to the early withdrawal penalty, but IRA and 401(k)s should be your last resort in a financial emergency. Learn if a Tax Free or Tax Deferred IRA/401k is right for you.

Certified Public Accountant Ed Slott has developed a reputation as “America’s IRA expert” (see IRAHELP.com). Hans partnered with Ed and completed IRA-specific training with a goal to help clients with their IRAs and 401(k)s beyond what he learned as a Certified Financial Planner™ professional . Don’t try IRA planning on your own. Seek an advisor and attorney who know what they’re doing with IRAs.

Get In Touch

Contact us today with any questions, concerns, or just to stay connected.

Need help with your IRA?

The Learning Center

Recommended Blogs

- Income Taxes, IRAs, Life Insurance and Estate Planning, Long-Term Care, Medicare, Retirement Income, Social Security

- Life Insurance and Estate Planning